Vancouver, Canada – HIVE Blockchain Technologies Ltd. (TSX.V:HIVE) (OTCQX:HVBTF) (FSE: HBF) (the “Company” or “HIVE”) announces that it has achieved a record amount of Ethereum production in the current quarter driven by the continued strong usage of the blockchain network, notably for decentralized finance (“DeFi”) applications, and the positive impact this has had for industrial scale Ethereum miners such as HIVE. The Company also provided an update on the date of its financial statements and related filings for its first quarter ended June 30, 2020 of its fiscal year.

Ethereum Mining Update

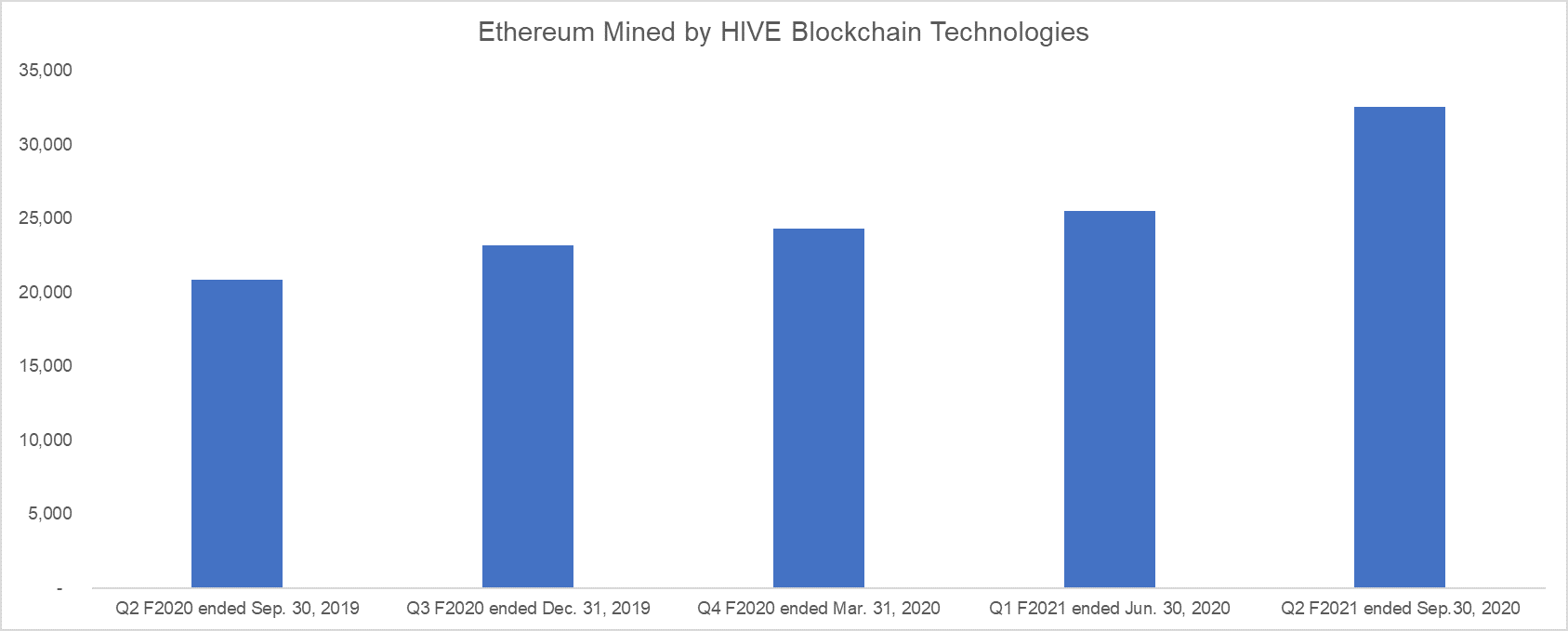

HIVE has thus far mined more than 32,000 Ethereum (and 121,000 Ethereum Classic) in the quarter from July 1 to September 30, 2020, based on the Company’s preliminary unaudited results. This represents a significant sequential increase from the approximately 25,000 Ethereum mined in HIVE’s first fiscal quarter ended June 30, 2020, and a more than 50% increase compared to the same period last year.

The increase has been driven by the massive demand for transactions on Ethereum, including by stablecoins and DeFi applications[1], which have resulted in record highs in Ethereum transaction fees paid to miners. Many investors are using smart contracts to perform DeFi actions such as staking, pooling, and lending and such investors have been paying higher costs to make sure their transactions go through.

Ether Coins Mined by HIVE Blockchain Technologies

HIVE has also significantly increased its cash flows from Ethereum mining in the current quarter driven by the combination of: its increased Ethereum production; the significant rise in the price of Ethereum; and, as reported by the Company previously, the significantly lower operating and maintenance costs achieved at the Company’s Ethereum mining facilities in Europe due to management’s decision to assume direct control of the Company’s mining operations over the past 18 months from its former strategic partner. Based on its operating and maintenance costs, the Company’s current cost to mine Ethereum is approximately US$150, while the average price of Ethereum in the quarter ended September 30, 2020 has been US$343[2].

The Company has been utilizing such cash flows to upgrade and expand its Ethereum mining equipment and support the scaling up of its recently acquired Bitcoin mining operation in Canada.

Financial Statements Update

As previously announced, due to circumstances created by the COVID-19 global pandemic, the Company is relying on the 45-day extension period for the filing of its financial statements and related materials provided to issuers by Canadian regulators, as enacted in Instrument 51-517 - Temporary Exemption from Certain Corporate Finance Requirements with Deadlines during the Period from June 2 to August 31, 2020 by the British Columbia Securities Commission ("BCSC") ("BC Instrument 51-517").

As required by BC Instrument 51-517, the Company discloses the following:

The Company now expects to file its financial statements and related management discussion and analysis for its first quarter ended June 30, 2020 of its fiscal year on or before October 15, 2020, as opposed to October 13 as the Company previously announced.

In the interim, the Company's management and other insiders are subject to a trading black-out policy that reflects the principles in Section 9 of National Policy 11-207 - Failure-to-File Cease Trade Orders.

The Company confirms that since the filing of its financial statements and related management discussion and analysis for the period ended March 31, 2020, there have been no material business developments other than those disclosed through news releases.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. is a growth oriented, TSX.V-listed company building a bridge from the blockchain sector to traditional capital markets. HIVE owns state-of-the-art green energy-powered data centre facilities in Canada, Sweden, and Iceland which produce newly minted digital currencies like Bitcoin and Ethereum continuously on the cloud. Our deployments provide shareholders with exposure to the operating margins of digital currency mining as well as a portfolio of crypto-coins.

For more information and to register to HIVE’s mailing list, please visit www.HIVEblockchain.com. Follow @HIVEblockchain on Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

“Frank Holmes”

Interim Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. “Forward-looking information” in this news release includes information about potential further improvements to profitability and efficiency across mining operations, filing of the Company’s financial statements and related management discussion and analysis for the first quarter of its fiscal year ended June 30, 2020, potential for the Company’s long-term growth, and the business goals and objectives of the Company.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, a decrease in Ethereum pricing, volume of transaction activity or generally, the profitability of Ethereum mining; further improvements to profitability and efficiency may not be realized; the Company may not file its financial statements and related management discussion and analysis for the first quarter of its fiscal year ended June 30, 2020 within the timeframe currently anticipated; the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on the Company’s operations; the volatility of digital currency prices; and other related risks as more fully set out in the Filing Statement of the Company dated and other documents disclosed under the Company’s filings at www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the current profitability in mining Ethereum (including pricing and volume of current transaction activity); the Company’s ability to prepare and file its financial statements and related management discussion and analysis for the first quarter of its fiscal year ended June 30, 2020; profitable use of the Company’s assets going forward; the Company’s ability to profitably liquidate its digital currency inventory as required; historical prices of digital currencies and the ability of the Company to mine digital currencies will be consistent with historical prices; and there will be no regulation or law that will prevent the Company from operating its business. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

[1] Sources include: Decrypt: https://decrypt.co/43055/ethereum-transaction-fees-fall-to-lowest-in-49-days-as-defi-craze-subsides Forbes: https://www.forbes.com/sites/rogerhuang/2020/09/24/defi-gas-inflation-on-ethereum-creates-opportunities-and-problems/#1e61511a2b0b,Glassnode: https://insights.glassnode.com/defi-spike-ethereum-gas-price/ and HASHR8: https://www.hashr8.com/blog/bitcoin-ethereum-miner-revenue-august-2020

[2] Such costs exclude depreciation, general & administrative costs, taxes and other expenses. The Ethereum average price is per Coinmarketcap.com.